Answer:

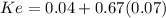

Ke 0.08690 = 8.69%

Step-by-step explanation:

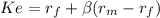

The capital assets price model formula(CAPM) is as follows:

risk free = 4% = 4/100 = 0.04

market rate = 11% = 11/100 = 0. 11

premium market: (market rate - risk free) = (0.11-0.04) = 0.07

Beta(non diversifiable risk) 0.67

Ke 0.08690