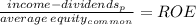

Answer:

ROE = 22.92%

Step-by-step explanation:

upper part:

income: 120,000

preferred stock dividends: 10,000

net: 110,000

average common equity:

(beginning + ending )/2

((300,000 + 75,000) + (400,000+ 185,000))/2 = 480,000

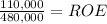

110,000/480,000 = 0.2291667 = 22.92%