Answer:

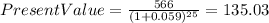

Ans. The present value of this firm´s liability is $135.03 millions.

Step-by-step explanation:

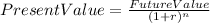

Hi, we need to use the following formula.

Where: r= our discount rate (5.9%); n=Years to pay (25). It should look like this:

So the present value of this liability is $135.03 millions.

Best of luck.