Answer:

The bonds price is $1,047.71

Step-by-step explanation:

The present value of a bond will be the coupon payment and maturity discounted at the current market rate.

We assume the bonds face value is 1,000 dollars.

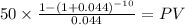

The coupon payment wil be an ordinary annuity:

C: 1,000 x 10%/2 payment per year = $50

time 10 (5 years x 2 payment per year)

rate 0.044 (8.8% annual / 2 = 4.4% semiannual)

PV $397.5884

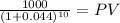

Then, maturity will be the present value of a lump sum

Maturity 1,000.00

time 10.00

rate 0.044

PV 650.12

We add both together and get:

PV of coupon payment + PV of maturity:

$397.5884 + $650.1222 = $1,047.7106