Answer:

Machine A: Net present value (801.147)

Machine B: Net present value (1,151,720)

As machine A has a better net present value that is the machine it should be purchased.

Step-by-step explanation:

We will calcualte the net present value of the revenues per year using the ordinary annuity.

Then, we subtract the turbine cost and get the net present value

the better numebr ill be the turbine to purchase

Machine A present worth:

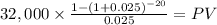

C $32,000

time: 20 years

rate 2.5% = 0.025

PV $498,853.1931

498,853 - 1,300,000 = 801.147

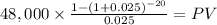

C $48,000

PV $748,279.7897

1,900,000 - 748,280 = 1,151,720