Answer:

It will require quarterly deposits of $ 171.06

Step-by-step explanation:

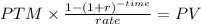

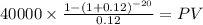

first we need to calcualte the present value of the retirement funds

and then, we will calcualte the PTM to achieve it.

1) present value of 40,000 semiannually over 10 years descounted at 6% cuarterly

PTM 40,000 dollars

time 20 810 years x 2 payment per year)

rate 0.12 (0.06 x 2)

PV $298,777.75

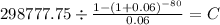

Now, we calcualte which PTM generate this amount over the course of 20 years

PV $298,777.74

time 80 (20 years x 4 quarter per year)

rate 0.06

C $ 171.063