Answer: 7.922%

Step-by-step explanation:

Bank 1 lends at nominal rate of 8% and payments made is semiannually,

So,

Semiannual rate of bank 1 = 4%

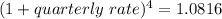

Effective annual rate of Bank 1:

= 8.16%

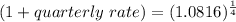

If Bank 2 wants to maintain the same level of EAR at quarterly compounding:

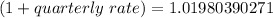

Quarterly rate = 1.01980390271 - 1

= 1.980390%

Nominal annual rate for Bank 2 = Quarterly rate × 4

= 1.980390% × 4

= 7.9215% or 7.922%