Answer:

the P/E ratio is 12.5

Step-by-step explanation:

the price-earning ratio represent how many times the earnings per shares "fits" into the price of the share. It represent how many years are needed to payback the investment of rchase the share.

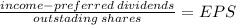

We first need the earningper share:

200,000 net income / 50,000 = 4 dollars EPS

price-earnings ratio:

50/4 = 12.5 years