Answer:

At Yield to maturity = 11%

Price = $1,000

Step-by-step explanation:

As for the provided information we have:

Par value = $1,000

Interest each year = $1,000

11% = $110

11% = $110

Effective interest rate semiannually = 11%/2 = 5.5% = 0.055

Since it is paid semiannually, interest for each single payment = $110

0.5 = $55 for each payment.

0.5 = $55 for each payment.

Time = 8 years, again for this since payments are semi annual, effective duration = 16

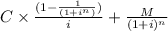

Price of the bond =

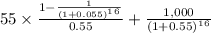

Here, C = Coupon payment = $55

i = 0.055

n = Time period = 16

M = Maturity value = Par value = $1,000

Therefore, if yield to maturity = 11% then,

P =

= $1,000