Answer:

$247,495.08 rounded to the nearest hundredth

Explanation:

In month 0 Kent would be receiving his current salary

4521.95

The interest rate is 6.96% annually, this is 0.58% monthly

In month 1 after his early retirement, he should be receiving

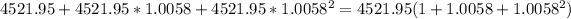

4521.95 + 4521.95*1.0058 = 4521.95(1+1.0058)

In month 2

and so on.

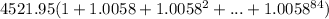

After 7 years (84 months), he should be getting

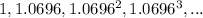

The sequence

is a geometric sequence with common ratio 1.0696

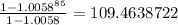

The sum of its first 84 terms is

so, he should be getting

4521.95*109.4638722=494,990.1567

Half this amount would be

$247,495.08 rounded to the nearest hundredth.