Answer:

Amount 10,841.08

Step-by-step explanation:

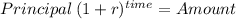

To know the value of the certificate of deposit in three-years we will use the compounding interest formula:

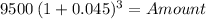

Principal $9,500.00

time = 3 years

rate = 4.5% = 4.5/100 = 0.045

Amount 10,841.08

The CD investment of Jonathan will return 10,841.08 in 3 years at the Dixie Bank rate.