Answer:

COst of equity using CAPM = 12.4%

Step-by-step explanation:

the market premium is the diference between the market rate and the risk-free rate.

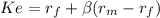

We plug the values into the formula for CAPM and solve for cost of equity

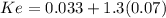

risk free 0.033

premium market = (market rate - risk free) 0.07

beta(non diversifiable risk) 1.3

Ke 0.12400 12.4%

The expected return will be 12.4%