Answer:

WACC = 12.25%

Step-by-step explanation:

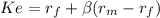

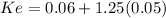

risk free 0.06

market rate

premium market market rate - risk free 0.05

beta(non diversifiable risk) 1.25

Ke 0.12250

The firm is unlevered, which means it has no debt, so the WACC wll be compose only for the cost of equity