Answer: 94.85

Explanation: we can compute stock price after two years by computing stock price today and multiplying it by square of growth rate.

we know that,

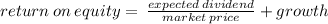

where,

expected dividend = current dividend (1+growth)

so, we can write the above equation as :-

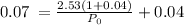

solving this equation we get:-

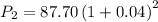

and price after two years:-