Solution:

Principal =P= $ 7,500

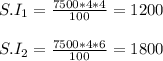

Option A→(Simple interest)

Rate of interest= R=4%

Time(

)=4 years

)=4 years

Time(

)=6 years

)=6 years

Amount= Principal + Interest(Simple or compound interest)

Formula for Simple interest

Total amount after 4 years when interest is simple= 7500 +1200= $ 8700

Total amount after 6 years when interest is simple= 7500 +1800= $ 9300

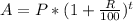

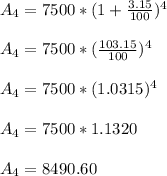

Option B

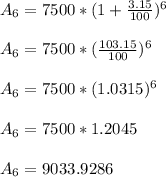

Formula for amount(A) when interest is 3.15% compounded annually.

Total amount after 4 years when interest is compounded annually=$ 8491 (approx)

Total amount after 6 years when interest is compounded annually=$ 9034(approx)