Answer:

480 million dollars

Explanation:

Given :

A state gets its money from a state lottery, a property tax, a sales tax of 5%, and an excise tax.

This year it projects that it will receive $28 million from the state lottery $36 million from the property tax, and $12 million from the excise tax.

To Find: If the state needs $100 million to cover its expenses, how many dollars worth of taxable items must be purchased in the state this year for the state to break even

Solution:

Let the total expenses be x

State lottery = $28 million

Property tax=$36 million

Excise tax=$12 million

Sales tax = 5% of x = 0.05x million

So, total expenses = (28+36+12+0.05x) million

Now we are given that the state needs $100 million to cover its expenses

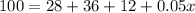

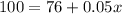

So, equation becomes:

Thus 480 million dollars worth of taxable items must be purchased in the state this year for the state to break even